The Brazil Electronic Customs Declaration (e-DBV) is a government-run digital system used by travelers entering or leaving Brazil who need to declare goods, currency, or items subject to inspection. It replaces the former paper-based customs forms and centralizes traveler declarations for customs compliance, taxation, and inspection procedures.

Travelers carrying items that exceed Brazil’s duty-free allowances, transporting large amounts of currency, traveling with restricted items, or bringing commercial goods must complete the e-DBV prior to arrival or departure, in accordance with government requirements.

Useful Information for Travelers Entering Brazil

First introduced in 1994, the Brazilian real (BRL) is the official currency of Brazil. Its primary symbol is R$, and it is abbreviated as BRL. Banknotes and coins feature imagery reflecting Brazil’s culture, wildlife, and national heritage.

The official language of Brazil is Portuguese, spoken nationwide and used in government, education, media, and business. Brazil is the largest Portuguese-speaking country in the world.

Approximately 203 million people (2023 estimate)

Brazil has a diverse climate due to its large geographic size, ranging from equatorial conditions in the north to temperate climates in the south.Key climate regions include:

• Equatorial Amazon – hot, humid, and rainy year-round

• Northeast / Semi-arid – high temperatures, long dry periods

• Central-West / Tropical Savanna – distinct wet and dry seasons

• Southeast / Subtropical – warm summers, mild winters

• South / Temperate – cooler winters, occasional frost

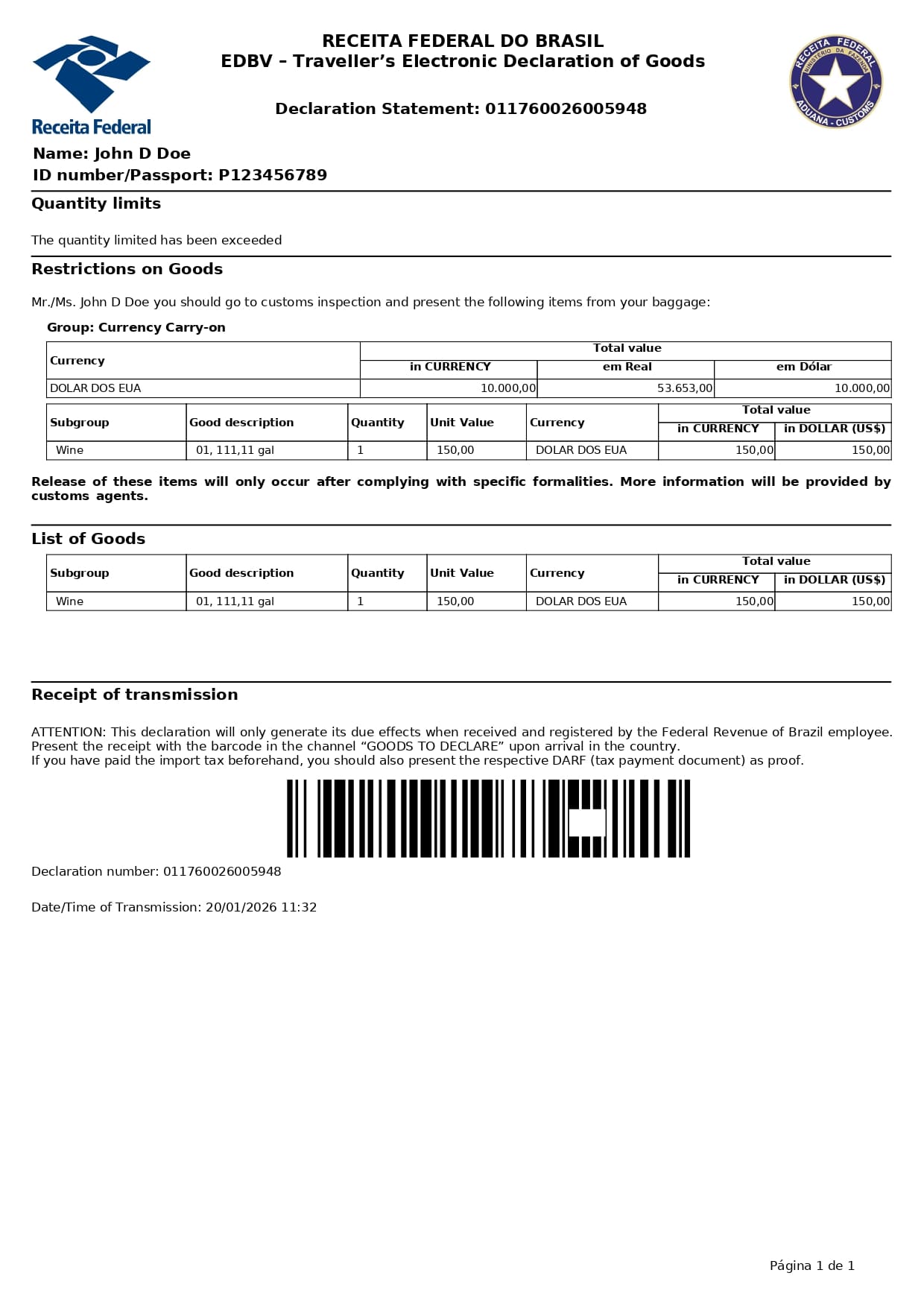

Example of a Brazil Electronic Customs Declaration Approval (for reference only)

Once submitted, the Electronic Traveler’s Goods Declaration (e-DBV) is processed by the Brazilian Customs (Receita Federal) online system. Travelers receive a confirmation of their declaration along with a QR code used for verification.

When accepted, the e-DBV details are electronically linked to the traveler’s passport and customs profile within the government system. There is no need to print a paper form, although keeping a screenshot of the QR code is recommended. Brazilian customs officers can verify the declaration electronically at the airport.A new e-DBV must be completed for each arrival or departure where goods, currency, or restricted items need to be declared.

If there are problems with your e-DBV submission — such as missing information, incorrect values, or undeclared goods — Brazilian Customs or airline staff may require you to correct or resubmit your declaration before boarding or upon arrival. It is essential that all details related to your personal information, goods, currency amounts, and receipts are accurate. Incomplete or incorrect declarations may cause delays, inspections, additional questioning, or in some cases, fines or taxes, until a proper declaration is completed.

Our service assists travelers in completing the Brazil e-DBV customs declaration accurately and on time. All verification, inspection, approval, and enforcement related to customs declarations are handled exclusively by Receita Federal do Brasil (Brazilian Customs Authority).